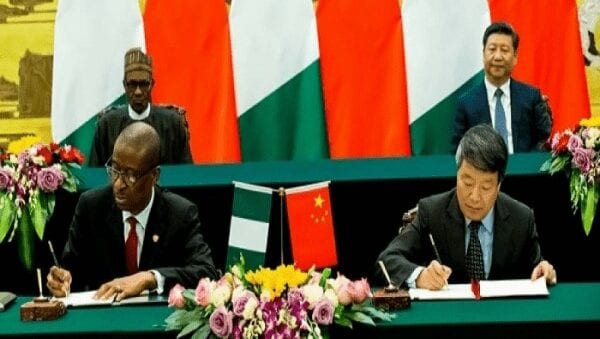

The Chinese Yaun deal is an economic move president Muhammadu Buhari took in his visit to China, but what does this move mean to the Nigerian economy? Very simple economics, We buy most of our goods from China, and we pay the Chinese in dollars, The Chinese buy a lot of crude oil from us, and they also pay us in dollars. So the President made a deal with the Chinese, We pay for the goods we buy from China in Yuan, the Chinese currency and they buy our crude oil and pay in Yuan. The exchange rate is to be pegged at 30 Naira to one Yuan or RMB.

So what is strategic about this move, well the Yuan is now 6.48 to a dollar, So if you pay 30 Naira to the Yuan, that would be equivalent to 194.4 Naira to the dollar. Since the dollar exchanges for 199 Naira, you save N4.6. 199 – 194.4 = 4.6.

In simple terms, PMB has just strengthened the Naira by 9.15%! And that’s not the end of the story. As we begin to deal in the Yuan, the demand for dollar would plummet and this in turn would weaken the dollar. It would crash to around 140 Naira to the dollar.

This move by the Buhari administration is almost a strategic one. You’d recall that the Naira/USD exchange rate took a dive during those troubled periods once Nigerian importers who had made deposits with Chinese firms began to source for dollars to meet their varying commitments. That exchange rate would have seen less pressure, were they sourcing for the Yuan instead, a currency Chinese firms will accept. The trade between Nigeria and China was once recorded at over $11b dollars with, of course, the imbalance being to Nigeria’s disfavour. But that’s not the point; Nigeria has never really been an exporting country.

Nevertheless, it’s obvious there’s a lot of trade going on between the two countries. Since you couldn’t exchange Naira directly for Yuan, but had to first obtain the USD, the various additional costs incurred during the two-stage transaction ensured Nigerian firms spent more money doing business with Chinese firms. In addition, by not first exchanging to the USD Nigeria can start reducing its dependence on the dollar. And now, I don’t have to tell you how much the greenback swings the Nigerian market.

Not to get it wrong though. This will not increase the money in Nigeria’s pocket, neither will it completely eliminate dependence on the dollar since some countries will not accept the Yuan while trading with Nigeria. In fact, Nigeria will have to convert a sizeable amount of its earning to the Chinese legal tender causing the country to hold less dollar. However, if a significant amount of trade is happening with China, there is no reason the Nigeria shouldn’t have a Yuan trading hub.

The Naira will be the latest in a string of currencies which currently trade with the Yuan. There is already direct trade with the dollar, euro, yen, pound, the Australian Aussie, the New Zealand dollar, Russia’s rouble, Swiss francs, the Singaporean dollar and the Malaysian ringgit. By joining the list of these countries, Nigeria is expressing its desire to take China seriously as a global economy and directly take on the benefits that come with that.

Dear Sir / Madam,

We offer all kind of loans – Business Loan / Real Estate Project

-Financing

We are a comprehensive financial

services firm committed to helping our clients improve their

long-term financial success.

Our customized programs are designed to help grow, protect, and

conserve our client’s wealth by delivering a superior level of

personalized service.

We’re Investment/Finance firm that specialized in project funding

& General financial service offer.Our principal function would be

assist you in complete financing through our reputable Lending

Institutions.

We are open to having a good business relationship with you. We

are currently interested in funding viable businesses,

investments or projects in the following areas of interest:

* Starting up a Franchise

* Business Acquisition

* Business Expansion

* Capital / Infrastructural Project

* Commercial Real Estate purchase

* Contract Execution

* Trade Financing etc.

* Want to be an Agent / Broker?

– Intermediaries/Consultants/Brokers are welcome to bring their

clients and are 100% protected.

We encourage you to contact us and learn more about the loans

service we offered.

FOR IMMEDIATE RESPONSE AND PROCESSING OF YOUR LOAN REQUEST WITHIN 2 WORKING DAYS,

Contact us directly through this email: lydiamooncooperativeloan@gmail.com

Contact us with the following information:

Full Name:____________________________

Amount Needed as Loan:________________

Loan Duration:_________________________

Purpose for Loan:______________________

Date of Birth:___________________________

Gender:_______________________________

Marital status:__________________________

Contact Address:_______________________

City/Zip code:__________________________

Country:_______________________________

Occupation:____________________________

Mobile Phone:__________________________

Send your request for immediate response to: lydiamooncooperativeloan@gmail.com

Thank you.

LYDIA MOON

Director.

LYDIA MOON CO-OPERATIVE LOAN COMPANY

Welcome. BE NOT TROUBLED anymore. you’re at the right place. Nothing like having trustworthy hackers. have you lost money before or bitcoins and are looking for a hacker to get your money back? You should contact us right away. It’s very affordable and we give guarantees to our clients. Our hacking services are as follows: Website:https://creditcardsatm.wixsite.com/website Email:Creditcards.atm@gmail.com

-hack into any kind of phone

_Increase Credit Scores

_western union, bitcoin and money gram hacking

_criminal records deletion_BLANK ATM/CREDIT CARDS

_Hacking of phones(that of your spouse, boss, friends, and see whatever is being discussed behind your back)

_Security system hacking…and so much more. Contact THEM now and get whatever you want at

Email:Creditcards.atm@gmail.com

whats app:+1(305) 330-3282

Join our telegram channel via: https://t.me/joinchat/S_ZFxGlBnxQJ1SN_

Perfect piece of work you have done, this internet site is really cool with fantastic info .

Hello Every One,My Name is Mrs Rebecca Moses,, i live in USA and life is worth living comfortably for me and my family now and i really have never seen goodness shown to me this much in my life as i am a struggling mum with three kids and i have been going through a serious problem as my husband encountered a terrible accident last two weeks, and the doctors states that he needs to undergo a delicate surgery for him to be able to walk again and i could not afford the bills for his surgery then i went to the bank for a loan and they turn me down stating that i have no credit card, from there i run to my father and he was not able to help, then when i was browsing through yahoo answers and i came across a loan lender MR Stephen Wilson,who provides loans at an affordable interest rate and i have been hearing about so many scams on the internet but at this my desperate situation, i had no choice than to give it an attempt and surprisingly it was all like a dream, i received a loan of $70,000 USD and i payed for my husband surgery and thank GOD today he is okay and can walk and is working and the burden is longer so much on me any more and we can feed well and my family is happy today and i said to my self that i will shout aloud to the world of the wonders of GOD to me through this GOD fearing lender MR Stephen Wilson and i will advise anyone in genuine and serious need of loan to contact this GOD fearing man via..consumerloanfirm@gmail.com,and i want you all to pray for this man for me because he has done alot in my family,and i pray that god will continue to bless you for the good you have done for my family. THANKS Mrs Rebecca Moses