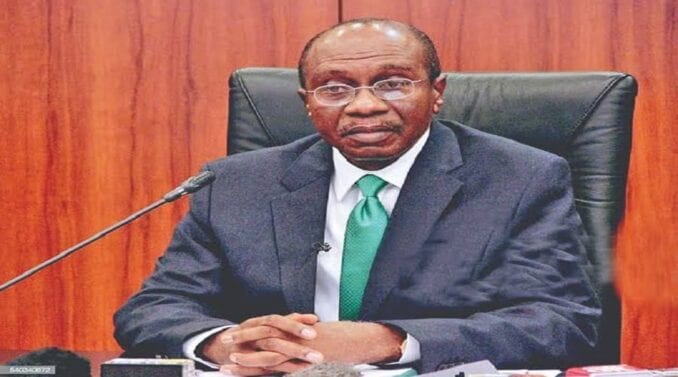

CBN clarifies policy on transactions in domiciliary accounts – The Central Bank of Nigeria (CBN) has restricted the process of cash withdrawal of electronic transfer deposits made into domiciliary accounts.

The apex bank disclosed in a tweet, stating that deposits made through electronic transfers into domiciliary accounts can only be transferred but cannot be withdrawn as cash over the counter.

The CBN added that cash deposits also made into domiciliary accounts can only be withdrawn as cash over the counter and not transferred out of the domiciliary account.

The CBN tweet said “Only transfers into domiciliary accounts can be transferred from such accounts while cash deposits into such accounts can only be withdrawn in cash.”

Meanwhile, the tweet was made in response to speculation that the apex regulator in Nigeria had banned the acceptance of foreign currency as cash deposits in Deposit Money Banks (DMBs).

The CBN denied that it had given any such directive to the DMBs operating within the country and any information contrary to this is false.

The CBN tweet said “The CBN has not prohibited acceptance of foreign currency as cash deposits by DMBs. Rumors to the contrary are false”

What this means: If a bank customer made an electronic transfer of $5,000 into his domiciliary account and later goes to the bank to make a cash deposit of $10,000, making a total of $15,000 in the account. Such customer can only make withdrawals from the account in the manner/medium he used to make the deposits into the domiciliary account.

It means if the bank customer needs to make a payment of $12,000 or initiates a transaction of $12,000, he can only pay $5, 000 through electronic transfer and the reaming $7,000 would have to be paid in cash.

The new CBN directive comes as a surprise to Nigerians as shown in their responses to the tweets on Saturday. Now, Nigerians are left with making cash deposits into beneficiary’s account or instead of taking cash, the beneficiary request for a transfer to be made into such account given is future or current need for the money.

*GOOD DAY MA/SIR*

Have you had about *LAVITA RICCA INVESTMENT* ? am not talking about MMM or Ponzi SCHEME

lavita is a matrix system which give you DOUBLE of your CAPITAL back in (45 min) after registration

LAVITA PACKAGES

₦10,000——–₦20,000❌❌❌

₦20,000——–₦40,000

₦40,000——–₦80,000

₦50,000——–₦100,000

₦100,000——₦200,000

₦200,000——₦400,000

₦400,000——₦800,000

₦800,000——₦1,600,000

₦1,000,000—₦2,000,000

NOTE: we credit your account after 45min after registeration.

INTRODUCTION

Lavita Ricca International is a company duely registered under the Coporate Affairs Commission of Nigeria and certified fraud free to do business in Nigeria by the Economic Financial Crimes Commission (EFCC). This is a Nigerian network marketing company founded by Mr. Ifeanyi Alex Monye with it’s Head Quarter’s. The company takes pride in the fact that it stands out amongst other network marketing companies. It has the best compensation plan, affordable and effective services, systems that keeps her customers coming back for more. When you join this company, you get more than their outstanding services.

CONTACT NAME:- ELIZABETH TINA

HOT LINE:+2349036369810

ITS SIMPLE HERE !!!!!!!

We trade with hard currency here like bit coin we make 3tripple of your donation and send you you two part and we benefit one part Example if you invest with 20k within 45mins we make profit of 60k then send 40k to you then profit 20k. This is not mmm where they merge people to donate for each other

You pay directly to us and we credit you directly.

https://api.whatsapp.com/send?phone=2349036369810&text=Am_in_interested_in_lavita_ricca_investment_how_do_i_register

Note:you get credited in less than 45mins.

CHAT US-UP IF INTEREST FILL YOUR FORM AND START EARNING

NOTE: You can finish reading this and decide not to take the necessary actions, but the next time you want to complain about not having money, just know that you are on your own problem.