Grayscale Adds Solana and Uniswap to Crypto Investment Fund – Grayscale Investments, the world’s largest digital currency asset manager, announced Friday the quarterly rebalancing of its two diversified portfolios: the large-cap fund and the defi (decentralized finance) fund.

For the Grayscale Digital Large Cap Fund (OTCQX: GDLC), the company sold some of the existing components and used the cash proceeds to purchase solana (SOL) and uniswap (UNI). Grayscale said:

[This is] the first time solana (SOL) will be included in a Grayscale investment vehicle.

This was also the first time uniswap was added to the large-cap fund. However, the token has been in the Grayscale Defi Fund since the portfolio launched in July.

At the end of the day on Oct. 1, the large-cap fund’s components were bitcoin (BTC), 62.19%; ethereum (ETH), 26.08%; cardano (ADA), 5.11%; solana (SOL), 3.24%; uniswap (UNI), 1.06%; chainlink (LINK), 0.82%; litecoin (LTC), 0.77%; and

bitcoin cash (BCH), 0.73%.

Grayscale Digital Large Cap Fund’s components as of Oct. 1. Source: Grayscale Investments.

The addition of solana and uniswap followed the addition of cardano (ADA) to the large-cap fund, announced in July.

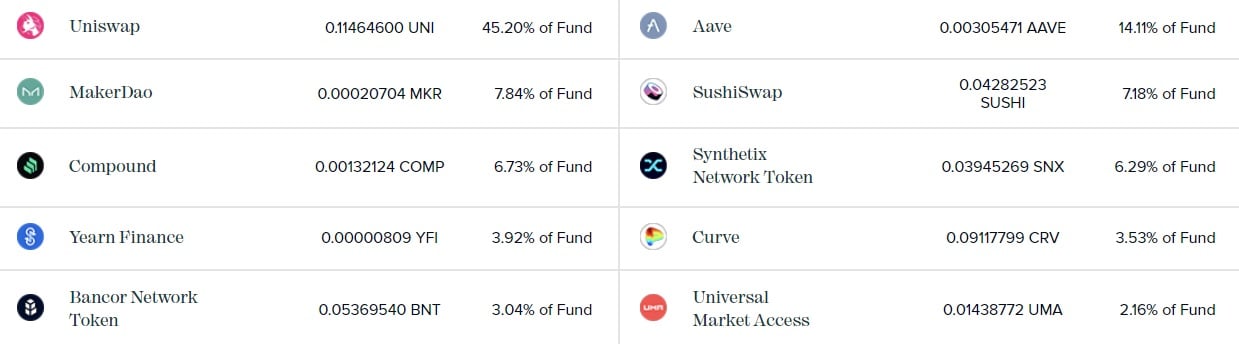

For the Grayscale Defi Fund, no new tokens were added or removed. At the end of the day on Oct. 1, the fund’s components were uniswap (UNI), 45.20%; aave (AAVE), 14.11%; makerdao (MKR), 7.84%; sushiswap (SUSHI), 7.18%; compound (COMP), 6.73%; synthetix (SNX), 6.29%; yearn finance (YFI), 3.92%; curve (CRV), 3.53%; bancor network token (BNT), 3.04%; and UMA Protocol (UMA), 2.16%.

Grayscale Defi Fund’s components as of Oct. 1. Source: Grayscale Investments.

Grayscale’s total assets under management (AUM) as of Oct. 1 was $41.5 billion. Besides the large-cap fund and the Defi fund, the company offers investments in single asset funds in bitcoin, bitcoin cash, basic attention token, chainlink, decentraland, ethereum, ethereum classic, filecoin, horizen, litecoin, livepeer, stellar lumens, and zcash.