Nigerian crypto adoption rises despite central bank’s efforts to quash it – Nigerian cryptocurrency adoption continues to rise in spite of government crackdown, with peer-to-peer (P2P) trade volume for Bitcoin posting its second strongest week on record last month.

According to data from Google Trends, Nigeria still ranks number by search interest for the keyword “Bitcoin” as of this writing. P2P Bitcoin trading denominated in the Nigerian Naira has also steadily increased in 2021, with Nigeria ranking behind only the United States as the second-largest market for peer-to-peer BTC trading, according to Useful Tulips.

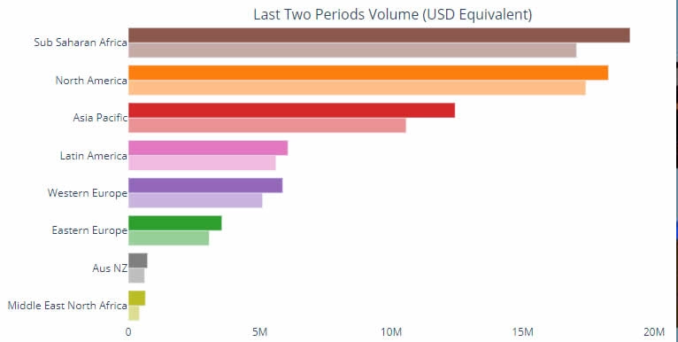

The growing Bitcoin adoption in Nigeria has helped Sub-Saharan Africa emerge as the leading region by P2P volume, with the region posting $18.8 million in weekly volume to beat out North America’s $18 million this past week.

A confluence of political and economic crises has spurred local crypto adoption, including social repression, currency controls, and rampant inflation.

Tensions in Nigeria have escalated since October, after massive public protests opposing police brutality and the infamous “Sars” police unit swept the nation.

The EndSars protests saw protestors attacked with tear gas and water cannons, with more than 50 civilians killed in total, including one dozen who were shot dead by police armed with live ammunition on October 20.

The government crackdown saw economic repression too, with social organizations supporting the protestors with food and medical aid quickly finding their bank accounts frozen. Amid the violence, protestors increasingly turned to cryptocurrency in order to place their economic activity outside of the government’s reach.

Adewunmi Emoruwa, the founder of Gatefield — a public policy organization whose accounts were suspended for providing grants to journalists covering the protests attributed Nigeria’s recent hostility regarding crypto assets to October’s protests, telling The Guardian:

“I think that EndSars is like the key catalyst for some of these decisions the government is making. It caused fear. They saw, for example, that people could decide to bypass government structures and institutions to mobilize.”

An anonymous source claiming to represent a social organization whose bank accounts were targeted during the turmoil, also told the publication that their group has been able to pay members’ salaries with crypto despite the financial embargo.

“We keep some securities in crypto – not too much but enough, sort of as an insurance policy,” they said. “When the ban happened we were, thankfully, able to pay salaries.”

In February, the government banned licensed banks from processing cryptocurrency transactions in an attempt to crack down on digital asset adoption.

However, Nigeria’s steadily rising P2P Bitcoin volumes suggest the country’s growing crypto user base has largely been driven underground in a bid to access crypto assets from outside of the government’s purview.

Marius Reitz, the Africa general manager of crypto trading platform Luno, told The Guardian that Nigeria’s ban has only made cryptocurrency trading harder to monitor, stating:

“A lot of trading activity has now been pushed underground, which means many Nigerians are now depending on less secure, less transparent over-the-counter channels, as well as Telegram and WhatsApp groups, where people trade directly with each other.”

The government’s moves to repress crypto have also received internal criticism, with Vice-President Yemi Osinbajo publicly rebuking the ban in February.

Despite the country’s hostility toward decentralized crypto assets, Nigeria is currently exploring the development of a central bank digital currency (CBDC).

In late July, Nigeria’s central bank revealed plans to begin trialing its CBDC from October 1 of this year.